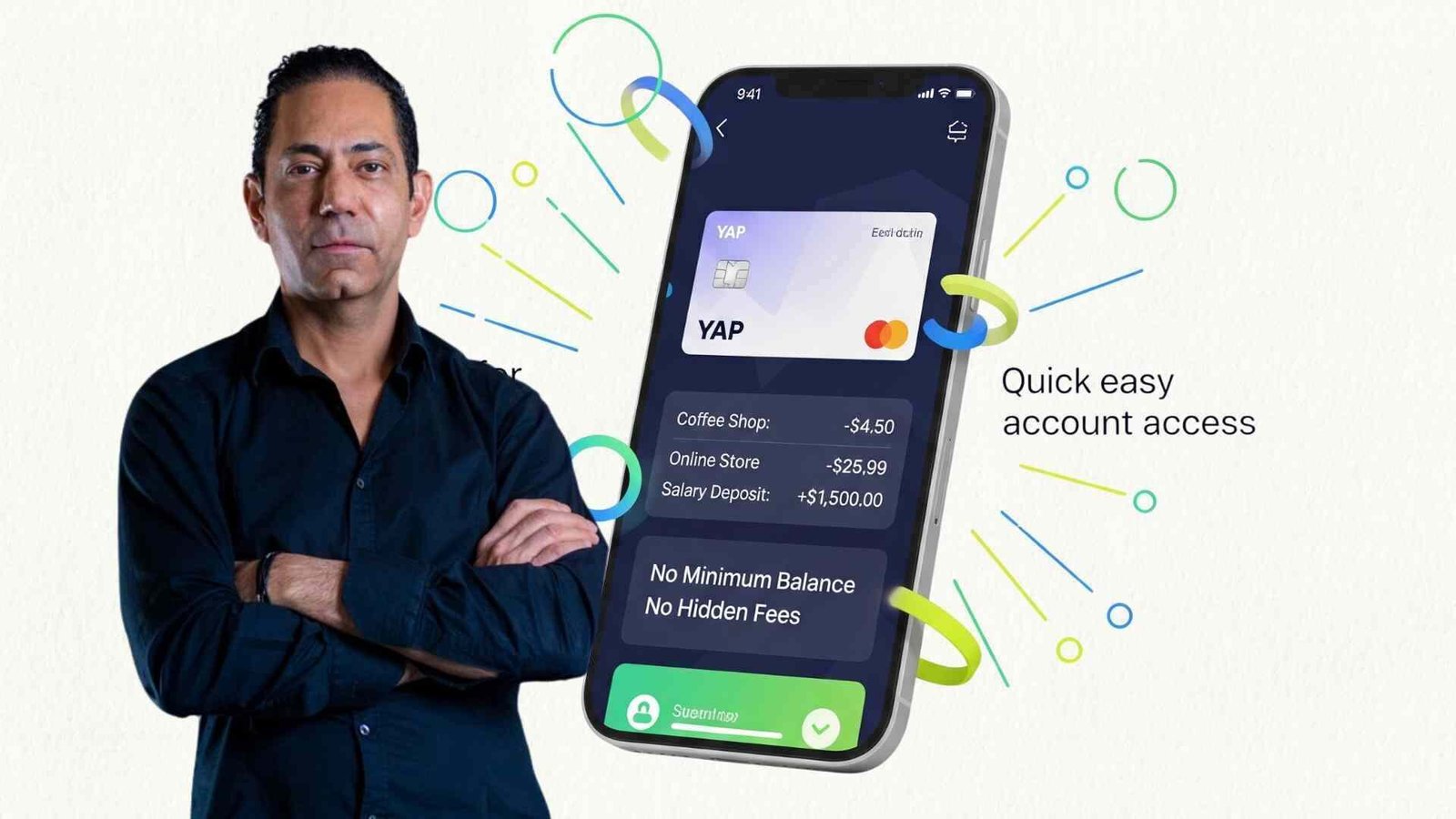

YAP’s app is a Dubai-born neobank that set out to make banking simple and mobile-first for residents of the UAE and beyond. The company launched in March 2021 after its founders partnered with RAK Bank to provide banking infrastructure and IBANs, allowing YAP to operate as an independent digital banking platform without a traditional branch network. The startup was co-founded by Marwan Hachem and Anas Zaidan. Marwan Hachem serves as the Group CEO, while Anas Zaidan is the Managing Director. Together with others from payments and fintech backgrounds, who aimed to replace paperwork and long waits with instant account opening and an app-first experience. Key Features of YAP YAP’s App offers a full digital banking experience through a smartphone app. Users get an instant IBAN-enabled account, virtual and physical debit cards, and real-time spend

Topics

- Artificial Intelligence

- companies

- Construct 360

- E-Commerce industry

- Economy News

- Economy News

- Editor Choice

- Edtech industry

- energy industry

- Entertainment & Leisure

- Entrepreneurs

- Featured

- Fintech

- Funding News

- General News

- Government Policies

- Growth & Strategy

- Health & Wellness

- Healthtech

- industry

- Information & Communication Technology

- Lifestyle

- Management

- Management and Leadership

- Marketing & Branding

- Merger and Acquisition

- Money & Personal Finance

- News

- Oil and Gas

- Real Estate

- Sports and Productivity

- Start-up

- Technology

- Top 10 Listing Article

- Travel

- Women

More

Popular Categories